Advanced Contract and Financial Management 온라인 연습

최종 업데이트 시간: 2025년10월10일

당신은 온라인 연습 문제를 통해 CIPS L5M4 시험지식에 대해 자신이 어떻게 알고 있는지 파악한 후 시험 참가 신청 여부를 결정할 수 있다.

시험을 100% 합격하고 시험 준비 시간을 35% 절약하기를 바라며 L5M4 덤프 (최신 실제 시험 문제)를 사용 선택하여 현재 최신 43개의 시험 문제와 답을 포함하십시오.

정답: Part 1: What is meant by Return on Investment (ROI)? (8 marks)

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessing the financial viability of projects or contracts, ensuring they deliver value for money.

Below is a step-by- step

explanation:

Definition:

Net Profit = Total Returns C Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1. Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John.

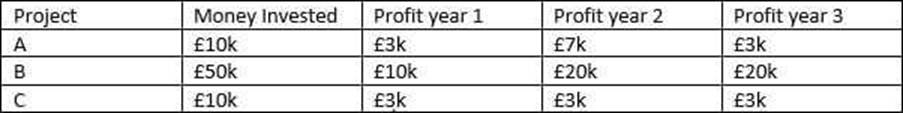

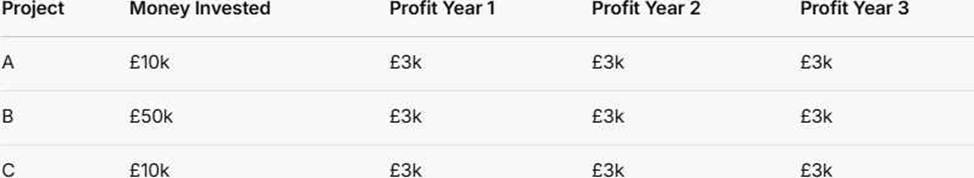

The table is as follows:

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit C Investment):

Project A: £9k C £10k = -£1k (a loss)

Project B: £9k C £50k = -£41k (a loss)

Project C: £9k C £10k = -£1k (a loss)

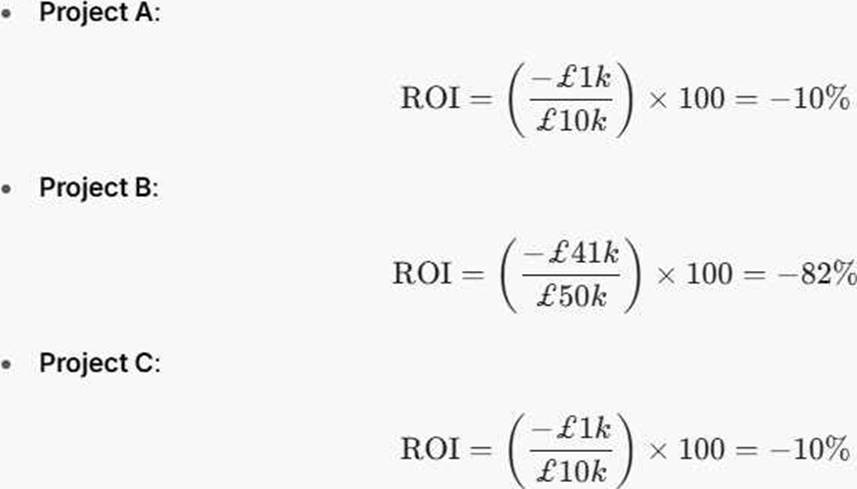

Step 3: Calculate ROI for Each Project:

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROI

All projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose either Project A or Project C over Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommend Project A.

Recommendation: John should choose Project A (or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss. Exact Extract Explanation

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers. Detailed Explanation

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects. It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations. Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s

projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels. Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs. Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should

consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing

A or C, as they have the least negative impact.

Reference: CIPS L5M4 Study Guide, Chapter 4: Financial Management in Contracts, Section on Financial Metrics and Investment Appraisal.

Additional

Reference: Chapter 2: Performance Management in Contracts, Section on Decision-Making Tools.

정답: Part 1: Describe what is meant by ‘Supply Chain Integration’ (8 marks)

Supply Chain Integration (SCI) refers to the seamless coordination and alignment of processes, information, and resources across all parties in a supply chain―suppliers, manufacturers, distributors, and buyers―to achieve a unified, efficient system. In the context of the CIPS L5M4

Advanced Contract and Financial Management study guide, SCI emphasizes collaboration to optimize performance and deliver value.

Below is a step-by-step

explanation: Definition:

SCI involves linking supply chain partners to work as a cohesive unit, sharing goals, data, and strategies.

It spans upstream (suppliers) and downstream (customers) activities.

Purpose:

Aims to eliminate silos, reduce inefficiencies, and enhance responsiveness to market demands.

Example: A buyer and supplier share real-time inventory data to prevent stockouts.

Part 2: How would a buyer go about implementing this approach and what benefits could be gained from it? (17 marks)

Implementation Steps:

Establish Collaborative Relationships:

Build trust and partnerships with suppliers through regular communication and joint planning.

Example: Set up quarterly strategy meetings with key suppliers.

Implement Information Sharing Systems:

Use technology (e.g., ERP systems, cloud platforms) to share real-time data on demand, inventory, and forecasts.

Example: Integrate a supplier’s system with the buyer’s to track orders live.

Align Objectives and KPIs:

Agree on shared goals and performance metrics (e.g., delivery speed, cost reduction) to ensure mutual accountability.

Example: Both parties target a 95% on-time delivery rate.

Streamline Processes:

Redesign workflows (e.g., joint procurement or production planning) to eliminate redundancies.

Example: Co-develop a just-in-time delivery schedule.

Benefits:

Improved Efficiency:

Streamlined operations reduce waste and lead times.

Example: Cutting order processing time from 5 days to 2 days. Cost Savings:

Better coordination lowers inventory holding costs and optimizes resource use.

Example: Reducing excess stock by 20% through shared forecasting.

Enhanced Responsiveness:

Real-time data enables quick adaptation to demand changes.

Example: Adjusting supply within 24 hours of a sales spike.

Stronger Relationships:

Collaboration fosters trust and long-term supplier commitment.

Example: A supplier prioritizes the buyer during shortages. Exact Extract Explanation

Part 1: What is Supply Chain Integration?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not dedicate a specific section to SCI but embeds it within discussions on supplier relationships and performance optimization. It describes SCI as "the alignment of supply chain activities to achieve a seamless flow of goods, services, and information." The guide positions it as a strategic approach to enhance contract outcomes by breaking down barriers between supply chain partners, aligning with its focus on value delivery and financial efficiency.

Detailed Explanation

SCI integrates processes like procurement, production, and logistics across organizations. The guide notes that "effective supply chains require coordination beyond contractual obligations," emphasizing shared goals over transactional interactions.

For example, a manufacturer (buyer) integrating with a raw material supplier ensures materials arrive just as production ramps up, avoiding delays or overstocking. This reflects L5M4’s emphasis on operational and financial synergy.

Part 2: Implementation and Benefits

The study guide highlights SCI as a means to "maximize efficiency and value," linking it to contract management and financial performance. It provides implicit guidance on implementation and benefits through its focus on collaboration and performance metrics. Implementation Steps:

Establish Collaborative Relationships:

Chapter 2 stresses "partnership approaches" to improve supplier performance. This starts with trust-building activities like joint workshops, aligning with SCI’s collaborative ethos. Implement Information Sharing Systems:

The guide advocates "technology-enabled transparency" (e.g., shared IT platforms) to enhance visibility, a cornerstone of SCI. This reduces guesswork and aligns supply with demand. Align Objectives and KPIs:

L5M4 emphasizes "mutually agreed performance measures" (e.g., KPIs like delivery accuracy). SCI requires this alignment to ensure all parties work toward common outcomes. Streamline Processes:

The guide suggests "process optimization" through collaboration, such as synchronized planning, to

eliminate inefficiencies―a practical step in SCI.

Benefits:

Improved Efficiency:

The guide links integrated processes to "reduced cycle times," a direct outcome of SCI. For instance, shared data cuts delays, aligning with operational goals. Cost Savings:

Chapter 4 highlights "minimizing waste" as a financial management priority. SCI reduces excess inventory and transport costs, delivering tangible savings. Enhanced Responsiveness:

The guide notes that "agile supply chains adapt to market shifts," a benefit of SCI’s real-time coordination. This supports competitiveness, a strategic L5M4 focus. Stronger Relationships:

Collaboration "builds resilience and trust," per the guide. SCI fosters partnerships, ensuring suppliers prioritize the buyer’s needs, enhancing contract stability. Practical Application:

For XYZ Ltd (from Question 7), SCI might involve integrating a raw material supplier into their production planning. Implementation includes an ERP link for inventory data, aligned KPIs (e.g., 98% delivery reliability), and joint scheduling. Benefits could include a 15% cost reduction, 3-day faster lead times, and a supplier committed to priority service during peak demand.

The guide advises balancing integration costs (e.g., IT investment) with long-term gains, a key

financial consideration in L5M4.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Relationships and Collaboration.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Efficiency and Cost Management.

정답: Part 1: Describe what is meant by Early Supplier Involvement (10 marks)

Early Supplier Involvement (ESI) refers to the practice of engaging suppliers at the initial stages of a project or product development process, rather than after specifications are finalized. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ESI is a collaborative strategy that integrates supplier expertise into planning, design, or procurement phases to optimize outcomes.

Below is a step-by-step

explanation:

Definition:

ESI involves bringing suppliers into the process early―often during concept development, design, or pre-contract stages―to leverage their knowledge and capabilities.

It shifts from a traditional sequential approach to a concurrent, partnership-based model.

Purpose:

Aims to improve product design, reduce costs, enhance quality, and shorten time-to-market by incorporating supplier insights upfront.

Example: A supplier of raw materials advises on material selection during product design to ensure manufacturability.

Part 2: Benefits and Disadvantages to this Approach (15 marks)

Benefits:

Improved Design and Innovation:

Suppliers contribute technical expertise, leading to better product specifications or innovative solutions.

Example: A supplier suggests a lighter material, reducing production costs by 10%.

Cost Reduction:

Early input helps identify cost-saving opportunities (e.g., alternative materials) before designs are locked in.

Example: Avoiding expensive rework by aligning design with supplier capabilities.

Faster Time-to-Market:

Concurrent planning reduces delays by addressing potential issues (e.g., supply constraints) early.

Example: A supplier prepares production capacity during design, cutting lead time by weeks. Disadvantages:

Increased Coordination Effort:

Requires more upfront collaboration, which can strain resources or complicate decision-making.

Example: Multiple stakeholder meetings slow initial progress.

Risk of Dependency:

Relying on a single supplier early may limit flexibility if they underperform or exit.

Example: A supplier’s failure to deliver could derail the entire project. Confidentiality Risks:

Sharing sensitive design or strategy details early increases the chance of leaks to competitors.

Example: A supplier inadvertently shares proprietary specs with a rival.

Exact Extract Explanation

Part 1: What is Early Supplier Involvement?

The CIPS L5M4 Advanced Contract and Financial Management study guide discusses ESI within the context of supplier collaboration and performance optimization, particularly in complex contracts or product development. While not defined in a standalone section, it is referenced as a strategy to "engage suppliers early in the process to maximize value and efficiency." The guide positions ESI as part of a shift toward partnership models, aligning with its focus on achieving financial and operational benefits through strategic supplier relationships.

Detailed Explanation

ESI contrasts with traditional procurement, where suppliers are selected post-design. The guide notes that "involving suppliers at the specification stage" leverages their expertise to refine requirements, ensuring feasibility and cost-effectiveness.

For instance, in manufacturing, a supplier might suggest a more readily available alloy during design, avoiding supply chain delays. This aligns with L5M4’s emphasis on proactive risk management and value creation.

The approach is often linked to techniques like Simultaneous Engineering (covered elsewhere in the guide), where overlapping tasks enhance efficiency.

Part 2: Benefits and Disadvantages

The study guide highlights ESI’s role in delivering "strategic value" while cautioning about its challenges, tying it to financial management and contract performance principles. Benefits:

Improved Design and Innovation:

The guide suggests that "supplier input can enhance product quality and innovation," reducing

downstream issues. This supports L5M4’s focus on long-term value over short-term savings.

Cost Reduction:

Chapter 4 emphasizes "minimizing total cost of ownership" through early collaboration. ESI avoids costly redesigns by aligning specifications with supplier capabilities, a key financial management goal.

Faster Time-to-Market:

The guide links ESI to "efficiency gains," noting that concurrent processes shorten development

cycles. This reduces holding costs and accelerates revenue generation, aligning with financial

efficiency.

Disadvantages:

Increased Coordination Effort:

The guide warns that "collaborative approaches require investment in time and resources." For ESI, this means managing complex early-stage interactions, potentially straining procurement teams. Risk of Dependency:

L5M4’s risk management section highlights the danger of over-reliance on key suppliers. ESI ties the buyer to a supplier early, risking disruption if they fail to deliver.

Confidentiality Risks:

The guide notes that sharing information with suppliers "increases exposure to intellectual property risks." In ESI, sensitive data shared prematurely could compromise competitive advantage. Practical Application:

For a manufacturer like XYZ Ltd (from Question 7), ESI might involve a raw material supplier in designing a component, ensuring it’s cost-effective and producible. Benefits include a 15% cost saving and a 3-week faster launch, but disadvantages might include extra planning meetings and the risk of locking into a single supplier.

The guide advises balancing ESI with risk mitigation strategies (e.g., confidentiality agreements, multiple supplier options) to maximize its value.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Collaboration and Strategic Relationships.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Cost Optimization and Risk Management.

정답: Selecting the right supplier is a critical decision for XYZ Ltd, a manufacturing organization, to ensure the supply of raw materials meets operational, financial, and strategic needs. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, supplier selection criteria should align with achieving value for money, operational efficiency, and long-term partnership potential. Below are five detailed selection criteria XYZ Ltd could use, explained step-by-step: Cost Competitiveness:

Description: The supplier’s pricing structure, including unit costs, discounts, and total cost of ownership (e.g., delivery or maintenance costs).

Why Use It: Ensures financial efficiency and budget adherence, a key focus in L5M4.

Example: A supplier offering raw materials at $10 per unit with free delivery might be preferred over

one at $9 per unit with high shipping costs.

Quality of Raw Materials:

Description: The consistency, reliability, and compliance of materials with specified standards (e.g., ISO certifications, defect rates).

Why Use It: High-quality materials reduce production defects and rework costs, supporting operational and financial goals.

Example: A supplier with a defect rate below 1% and certified quality processes.

Delivery Reliability:

Description: The supplier’s ability to deliver materials on time and in full, measured by past performance or promised lead times.

Why Use It: Ensures manufacturing schedules are met, avoiding costly downtime.

Example: A supplier guaranteeing 98% on-time delivery within 5 days.

Financial Stability:

Description: The supplier’s economic health, assessed through credit ratings, profitability, or debt levels.

Why Use It: Reduces the risk of supply disruptions due to supplier insolvency, aligning with L5M4’s risk management focus.

Example: A supplier with a strong balance sheet and no recent bankruptcies.

Capacity and Scalability:

Description: The supplier’s ability to meet current demand and scale production if XYZ Ltd’s needs grow.

Why Use It: Ensures long-term supply reliability and supports future growth, a strategic consideration in contract management.

Example: A supplier with spare production capacity to handle a 20% volume increase.

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes supplier selection as a foundational step in contract management, directly impacting financial performance and operational success. The guide advises using "robust criteria" to evaluate suppliers, ensuring they deliver value for money and mitigate risks. While it does not list these exact five criteria verbatim, they are derived from its principles on supplier appraisal and performance management. Criterion 1: Cost Competitiveness:

The guide stresses "total cost of ownership" (TCO) over just purchase price, a key financial management concept in L5M4. This includes direct costs (e.g., price per unit) and indirect costs (e.g., transport, storage). For XYZ Ltd, selecting a supplier with competitive TCO ensures budget efficiency.

Application: A supplier might offer lower initial costs but higher long-term expenses (e.g., frequent delays), making TCO a critical metric.

Criterion 2: Quality of Raw Materials:

Chapter 2 highlights quality as a "non-negotiable performance measure" in supplier evaluation. Poor-quality materials increase rework costs and affect product reliability, undermining financial goals.

Practical Example: XYZ Ltd might require suppliers to provide test samples or quality certifications, ensuring materials meet manufacturing specs.

Criterion 3: Delivery Reliability:

The guide links timely delivery to operational efficiency, noting that "supply chain disruptions can have significant cost implications." For a manufacturer like XYZ Ltd, late deliveries could halt production lines, incurring penalties or lost sales.

Measurement: Past performance data (e.g., 95% on-time delivery) or contractual commitments to lead times are recommended evaluation tools.

Criterion 4: Financial Stability:

L5M4’s risk management section advises assessing a supplier’s "financial health" to avoid dependency on unstable partners. A financially shaky supplier risks failing mid-contract, disrupting XYZ Ltd’s supply chain.

Assessment: Tools like Dun & Bradstreet reports or financial statements can verify stability, ensuring long-term reliability.

Criterion 5: Capacity and Scalability:

The guide emphasizes "future-proofing" supply chains by selecting suppliers capable of meeting evolving demands. For XYZ Ltd, a supplier’s ability to scale production supports growth without the cost of switching vendors.

Evaluation: Site visits or capacity audits can confirm a supplier’s ability to handle current and future volumes (e.g., 10,000 units monthly now, 12,000 next year). Broader Implications:

These criteria should be weighted based on XYZ Ltd’s priorities (e.g., 30% cost, 25% quality) and combined into a supplier scorecard, a method endorsed by the guide for structured decision-making. The guide also suggests involving cross-functional teams (e.g., procurement, production) to define criteria, ensuring alignment with manufacturing needs.

Financially, selecting the right supplier minimizes risks like stockouts or quality issues, which could inflate costs―aligning with L5M4’s focus on cost control and value delivery. Practical Application for XYZ Ltd:

Cost: Compare supplier quotes and TCO projections.

Quality: Request material samples and compliance certificates.

Delivery: Review historical delivery records or negotiate firm timelines.

Financial Stability: Analyze supplier financials via third-party reports.

Capacity: Assess production facilities and discuss scalability plans.

This multi-faceted approach ensures XYZ Ltd appoints a supplier that balances cost, quality, and

reliability, optimizing contract outcomes.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Appraisal and Selection.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Cost Management and Risk Mitigation.

정답: Part 1: What is a ‘Balanced Scorecard’? (15 marks)

A Balanced Scorecard (BSC) is a strategic performance management tool that provides a framework for measuring and monitoring an organization’s performance across multiple perspectives beyond just financial metrics. Introduced by Robert Kaplan and David Norton, it integrates financial and non-financial indicators to give a holistic view of organizational success. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, the BSC is relevant for evaluating contract performance and supplier relationships by aligning them with broader business objectives.

Below is a step-by-step

explanation:

Definition:

The BSC is a structured approach that tracks performance across four key perspectives: Financial, Customer, Internal Processes, and Learning & Growth.

It translates strategic goals into measurable objectives and KPIs.

Four Perspectives:

Financial Perspective: Focuses on financial outcomes (e.g., cost savings, profitability).

Customer Perspective: Measures customer satisfaction and service quality (e.g., delivery reliability).

Internal Process Perspective: Evaluates operational efficiency (e.g., process cycle time).

Learning & Growth Perspective: Assesses organizational capability and innovation (e.g., staff training levels).

Application in Contracts:

In contract management, the BSC links supplier performance to strategic goals, ensuring alignment with financial and operational targets.

Example: A supplier’s on-time delivery (Customer) impacts cost efficiency (Financial) and requires process optimization (Internal Processes).

Part 2: What would be the benefits of using one? (10 marks)

The Balanced Scorecard offers several advantages, particularly in managing contracts and supplier

performance. Below are the key benefits:

Holistic Performance View:

Combines financial and non-financial metrics for a comprehensive assessment.

Example: Tracks cost reductions alongside customer satisfaction improvements.

Improved Decision-Making:

Provides data-driven insights across multiple dimensions, aiding strategic choices.

Example: Identifies if poor supplier training (Learning & Growth) causes delays (Internal Processes).

Alignment with Strategy:

Ensures contract activities support broader organizational goals.

Example: Links supplier innovation to long-term competitiveness. Enhanced Communication:

Offers a clear framework to share performance expectations with suppliers and stakeholders.

Example: A BSC report highlights areas needing improvement, fostering collaboration.

Exact Extract Explanation

Part 1: What is a ‘Balanced Scorecard’?

The CIPS L5M4 Advanced Contract and Financial Management study guide does not explicitly define the Balanced Scorecard in a dedicated section but references it within the context of performance measurement tools in contract and supplier management. It aligns with the guide’s emphasis on "measuring performance beyond financial outcomes" to ensure value for money and strategic success. The BSC is presented as a method to "balance short-term financial goals with long-term capability development," making it highly relevant to contract management.

Detailed Explanation

The guide explains that traditional financial metrics alone (e.g., budget adherence) are insufficient for assessing contract success. The BSC addresses this by incorporating the four perspectives: Financial: Ensures contracts deliver cost efficiencies or ROI, a core L5M4 focus. Example KPI: "Cost per unit reduced by 5%."

Customer: Links supplier performance to end-user satisfaction, such as "95% on-time delivery." Internal Processes: Monitors operational effectiveness, like "reduced procurement cycle time by 10%."

Learning & Growth: Focuses on capability building, such as "supplier staff trained in new technology." In practice, a BSC for a supplier might include KPIs like profit margin (Financial), complaint resolution time (Customer), defect rate (Internal Processes), and innovation proposals (Learning & Growth).

The guide stresses that the BSC is customizable, allowing organizations to tailor it to specific contract goals, such as sustainability or quality improvement.

Part 2: Benefits of Using a Balanced Scorecard

The study guide highlights the BSC’s value in providing "a structured approach to performance management" that supports financial and strategic objectives. Its benefits are implicitly tied to L5M4’s focus on achieving value for money and managing supplier relationships effectively. Holistic Performance View:

The guide notes that relying solely on financial data can overlook critical issues like quality or supplier capability. The BSC’s multi-perspective approach ensures a rounded evaluation, e.g., identifying if cost savings compromise service levels. Improved Decision-Making:

By presenting performance data across all four areas, the BSC helps managers prioritize actions. The guide suggests that "performance tools should inform corrective measures," and the BSC excels here by linking cause (e.g., poor training) to effect (e.g., delays). Alignment with Strategy:

Chapter 2 emphasizes aligning supplier performance with organizational goals. The BSC achieves this by translating high-level objectives (e.g., "improve market share") into actionable supplier metrics (e.g., "faster product development").

Enhanced Communication:

The guide advocates clear performance reporting to stakeholders. The BSC’s visual framework (e.g., a dashboard) simplifies discussions with suppliers, ensuring mutual understanding of expectations and progress.

Practical Example:

A company using a BSC might evaluate a supplier contract with:

Financial: 10% cost reduction achieved.

Customer: 98% customer satisfaction score.

Internal Processes: 2-day order processing time.

Learning & Growth: 80% of supplier staff certified in quality standards.

This holistic view ensures the contract delivers both immediate financial benefits and sustainable

value, a key L5M4 principle.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Performance Measurement Tools.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Value for Money and Strategic Alignment.

정답: Tracking the performance of a services contract, such as the provision of IT services to an office, requires robust methods to ensure the supplier meets operational, financial, and contractual expectations. The CIPS L5M4 Advanced Contract and Financial Management study guide underscores the importance of systematic monitoring to achieve value for money and maintain service quality. Below are five comprehensive ways to track performance, detailed step-by-step:

Key Performance Indicators (KPIs):

Description: Establish specific, measurable metrics tied to contract objectives to evaluate service delivery consistently.

Application: For IT services, KPIs could include system uptime (e.g., 99.9% availability), average resolution time for incidents (e.g., under 2 hours), or first-call resolution rate (e.g., 90% of issues resolved on initial contact).

Process: Use automated tools like IT service management (ITSM) software (e.g., ServiceNow) to collect data, generating regular reports for review.

Outcome: Provides quantifiable evidence of performance, enabling proactive management of service levels and cost efficiency.

Service Level Agreements (SLAs) Monitoring:

Description: Track adherence to predefined service standards outlined in SLAs within the contract. Application: An SLA might require critical IT issues to be addressed within 30 minutes or ensure no more than 1 hour of unplanned downtime per month.

Process: Monitor compliance using ticketing systems or logs, comparing actual performance against SLA targets, with escalation procedures for breaches.

Outcome: Ensures contractual commitments are met, with mechanisms like penalties or credits to enforce accountability.

Regular Performance Reviews and Audits:

Description: Conduct scheduled evaluations and audits to assess both qualitative and quantitative aspects of service delivery.

Application: Monthly reviews might analyze incident trends or user complaints, while an annual audit could verify cybersecurity compliance (e.g., ISO 27001 standards).

Process: Hold meetings with the supplier, review performance data, and audit processes or systems using checklists or third-party assessors.

Outcome: Offers a holistic view of performance, fostering collaboration and identifying improvement opportunities.

User Feedback and Satisfaction Surveys:

Description: Collect feedback from office staff (end-users) to gauge the perceived quality and effectiveness of IT services.

Application: Surveys might ask users to rate helpdesk responsiveness (e.g., 4.5/5) or system reliability, with qualitative comments on pain points.

Process: Distribute surveys quarterly via email or an internal portal, analyze results, and discuss findings with the supplier.

Outcome: Captures user experience, providing insights that quantitative metrics might miss, such as staff morale impacts.

Financial Performance Tracking:

Description: Monitor costs and financial outcomes to ensure the contract remains within budget and delivers economic value.

Application: Track metrics like cost per service ticket (e.g., $40 per incident), total expenditure vs. budget (e.g., within 2% variance), or savings from preventive maintenance (e.g., 10% reduction in repair costs).

Process: Review invoices, cost reports, and benchmark against industry standards or previous contracts.

Outcome: Aligns service performance with financial goals, ensuring cost-effectiveness over the contract lifecycle.

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide positions performance

tracking as a critical activity to "ensure supplier accountability and value delivery" in services contracts. Unlike goods-based contracts, services like IT provision require ongoing monitoring due to their intangible nature and reliance on consistent delivery. The guide provides frameworks for measuring performance, which these five methods reflect.

Way 1: Key Performance Indicators (KPIs):

The guide describes KPIs as "essential tools for monitoring contract performance" (Chapter 2). For IT services, it suggests metrics like "service availability" (e.g., uptime) and "response times" to assess operational success.

Detailed Use: A KPI of 99.9% uptime ensures minimal disruption to office productivity, while a 90% first-call resolution rate reduces downtime costs. The guide stresses that KPIs must be SMART (Specific, Measurable, Achievable, Relevant, Time-bound) and agreed upon during contract negotiation.

Financial Tie-In: Efficient KPIs lower operational costs (e.g., fewer escalations), aligning with L5M4’s focus on financial management.

Way 2: Service Level Agreements (SLAs) Monitoring:

SLAs are highlighted as "contractual benchmarks" that define acceptable service levels (Chapter 2). For IT contracts, the guide recommends SLAs like "maximum downtime" or "incident response time" to enforce standards.

Implementation: Monitoring via ITSM tools tracks SLA breaches (e.g., a 30-minute response target missed), triggering penalties or corrective actions. The guide notes SLAs "provide clarity and enforceability," critical for service reliability.

Outcome: Ensures financial penalties deter poor performance, protecting the buyer’s investment.

Way 3: Regular Performance Reviews and Audits:

The guide advocates "structured reviews" to evaluate supplier performance beyond metrics (Chapter 2). For IT services, reviews might assess trends (e.g., recurring outages), while audits verify compliance with security or data protection standards.

Practical Approach: Monthly meetings with the supplier review KPI/SLA data, while an audit might check server logs for uptime claims. The guide emphasizes audits for "high-risk contracts" like IT, where breaches could be costly.

Benefit: Balances operational oversight with financial risk management, a core L5M4 principle.

Way 4: User Feedback and Satisfaction Surveys:

Chapter 2 notes that "end-user satisfaction" is vital for services contracts, as it reflects real-world impact. The guide suggests surveys to capture qualitative data, complementing KPIs/SLAs. Execution: A survey rating helpdesk support at 4/5 might reveal delays not evident in response time metrics. The guide advises using feedback to "refine service delivery," ensuring user needs are met. Value: Links service quality to staff productivity, indirectly affecting financial outcomes (e.g., reduced downtime).

Way 5: Financial Performance Tracking:

The guide’s financial management section (Chapter 4) stresses tracking costs to ensure "value for money." For IT services, this includes monitoring direct costs (e.g., support fees) and indirect benefits (e.g., savings from fewer incidents).

Application: Benchmarking cost per ticket against industry norms (e.g., $40 vs. $50 average) ensures competitiveness. The guide advises analyzing "total cost of ownership" to capture long-term value. Alignment: Ensures the contract remains financially viable, a key L5M4 objective. Broader Implications:

These methods should be integrated into a performance management framework, with clear roles (e.g., contract manager overseeing reviews) and tools (e.g., software for KPI tracking).

The guide warns against over-reliance on one method―combining KPIs, SLAs, reviews, feedback,

and financial data provides a balanced view.

For IT services, performance tracking must adapt to evolving needs (e.g., new software rollouts), reflecting L5M4’s emphasis on flexibility in contract management.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Monitoring Service Contracts.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Cost Control and Value Assessment.

정답: Simultaneous Engineering (SE), also known as Concurrent Engineering, is a systematic approach to product development where multiple stages of design, manufacturing, and related processes are conducted concurrently rather than sequentially. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, SE is a strategy to optimize efficiency, reduce costs, and enhance collaboration between buyers and suppliers in contract execution.

Below is a detailed step-by-step explanation of its principles:

Concurrent Task Execution:

Description: Activities such as design, testing, and production planning occur simultaneously rather than in a linear sequence.

Purpose: Speeds up the development process and reduces time-to-market by overlapping tasks that traditionally follow one another.

Example: Engineers design a product while production teams prepare manufacturing setups concurrently, rather than waiting for the design to be fully completed.

Benefit: Accelerates project timelines, aligning with financial goals of minimizing delays and associated costs.

Cross-Functional Collaboration:

Description: Involves integrating multidisciplinary teams (e.g., design, engineering, procurement, suppliers) from the outset of the project.

Purpose: Ensures all perspectives are considered early, minimizing errors, miscommunication, and rework later in the process.

Example: A procurement team collaborates with designers to ensure material choices are cost-effective and available, while manufacturing flags potential production challenges. Benefit: Enhances decision-making quality and reduces costly downstream adjustments.

Early Supplier Involvement:

Description: Suppliers are engaged at the start of the project to contribute expertise and align their capabilities with design and production requirements.

Purpose: Improves manufacturability, reduces lead times, and ensures supplier processes are integrated into the project plan.

Example: A supplier suggests alternative materials during the design phase to improve durability and lower costs.

Benefit: Strengthens buyer-supplier relationships and aligns with L5M4’s focus on collaborative contract management.

Iterative Feedback and Continuous Improvement:

Description: Feedback loops are built into the process, allowing real-time adjustments based on testing, supplier input, or production insights.

Purpose: Identifies and resolves issues early, ensuring the final product meets quality and cost targets.

Example: Prototype testing reveals a design flaw, which is corrected before full-scale production begins.

Benefit: Reduces waste and rework, supporting financial efficiency objectives.

Use of Technology and Tools:

Description: Leverages advanced tools like Computer-Aided Design (CAD), simulation software, and project management systems to facilitate concurrent work.

Purpose: Enables real-time data sharing and coordination across teams and locations.

Example: A shared CAD platform allows designers and suppliers to collaborate on a 3D model simultaneously.

Benefit: Enhances accuracy and speeds up communication, reducing project costs and risks.

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide does not explicitly dedicate a section to Simultaneous Engineering, but its principles align closely with the module’s emphasis on efficient contract execution, supplier collaboration, and financial optimization. SE is implicitly referenced in discussions of "collaborative approaches" and "process efficiency" within supplier management and project delivery. The guide underscores the importance of integrating suppliers into contract processes to achieve value for money, a goal SE directly supports.

Principle 1: Concurrent Task Execution:

The guide highlights the need to "minimize delays in contract delivery" (Chapter 2), which SE achieves by overlapping tasks. This reduces the overall project timeline, a key financial consideration as prolonged timelines increase labor and overhead costs.

Context: For example, in a construction contract, designing the building while sourcing materials concurrently avoids sequential bottlenecks.

Principle 2: Cross-Functional Collaboration:

Chapter 2 emphasizes "team-based approaches" to ensure contract success. SE’s cross-functional principle mirrors this by uniting diverse stakeholders early. The guide notes that "effective communication reduces risks," which SE facilitates through integrated teams.

Financial Link: Early collaboration prevents costly redesigns, aligning with L5M4’s focus on cost control.

Principle 3: Early Supplier Involvement:

The guide advocates "supplier integration into the planning phase" to leverage their expertise (Chapter 2). SE formalizes this by involving suppliers from day one, ensuring their capabilities shape the project.

Example: A supplier’s early input on a component’s feasibility avoids later supply chain disruptions, reducing financial penalties or delays.

L5M4 Relevance: This supports the module’s theme of building strategic supplier relationships to enhance contract outcomes.

Principle 4: Iterative Feedback and Continuous Improvement:

The study guide stresses "proactive risk management" and "continuous monitoring" (Chapter 2). SE’s feedback loops align with this by catching issues early, such as a design flaw that could inflate production costs if undetected.

Financial Benefit: Early corrections minimize waste, supporting the guide’s focus on achieving value for money.

Principle 5: Use of Technology and Tools:

While not explicitly detailed in L5M4, the guide references "modern tools" for managing contracts efficiently (Chapter 4). SE’s reliance on technology like CAD or project management software enhances coordination, a principle that reduces errors and costs.

Example: Real-time updates via software ensure all parties work from the same data, avoiding misaligned efforts that could increase expenses. Broader Implications:

SE aligns with L5M4’s financial management goals by reducing time-to-market (lowering holding costs), improving quality (reducing defects), and optimizing resources (cutting waste).

It fosters a partnership approach, a recurring theme in the guide, where buyers and suppliers share risks and rewards. For instance, a shorter development cycle might allow both parties to capitalize on market opportunities sooner.

The guide’s focus on "whole-life costing" is supported by SE, as early collaboration ensures long-term cost efficiency (e.g., designing for maintainability).

Practical Application:

In a contract for a new product, SE might involve designers, suppliers, and production teams agreeing on specifications upfront, testing prototypes mid-process, and adjusting designs in real-time. This contrasts with traditional sequential methods, where delays and rework are common.

The guide suggests measuring success through KPIs like "time-to-completion" or "cost variance," which SE directly improves.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Collaborative Approaches and Supplier Integration.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Efficiency and Cost Optimization.

정답: Supplier development refers to the proactive efforts by a buying organization to improve a supplier’s capabilities, performance, or alignment with the buyer’s strategic goals. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, developing suppliers is a key strategy to enhance contract outcomes, achieve financial efficiencies, and ensure long-term value. Below are four detailed strategies a company could use, explained step-by-step: Training and Knowledge Sharing:

Description: Provide the supplier with training programs, workshops, or access to technical expertise to enhance their skills or processes.

Example: A company might train a supplier’s staff on lean manufacturing techniques to improve production efficiency.

Outcome: Increases the supplier’s ability to meet quality or delivery standards, reducing costs for both parties.

Joint Process Improvement Initiatives:

Description: Collaborate with the supplier to identify and implement process enhancements, such as adopting new technology or streamlining workflows.

Example: Co-developing an automated inventory system to reduce lead times.

Outcome: Enhances operational efficiency, aligning with financial management goals like cost reduction.

Performance Incentives and Rewards:

Description: Offer financial or contractual incentives (e.g., bonuses, extended contracts) to motivate the supplier to meet or exceed performance targets.

Example: A 5% bonus for achieving 100% on-time delivery over six months.

Outcome: Encourages continuous improvement and strengthens supplier commitment to the contract.

Investment in Supplier Resources:

Description: Provide direct financial or material support, such as funding new equipment or sharing resources, to boost the supplier’s capacity.

Example: Subsidizing the purchase of a high-precision machine to improve product quality.

Outcome: Enhances the supplier’s ability to deliver value, supporting long-term financial and operational benefits.

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes supplier development as a strategic approach to "improve supplier performance and capability" and ensure contracts deliver sustainable value. It is positioned as a proactive measure to address weaknesses, build resilience, and align suppliers with the buyer’s objectives, such as cost efficiency, quality improvement, or innovation. The guide highlights that supplier development is particularly valuable in strategic or long-term relationships where mutual success is critical.

Strategy 1: Training and Knowledge Sharing:

The guide notes that "sharing expertise" can elevate a supplier’s technical or operational skills, benefiting both parties. For instance, training on quality management systems (e.g., ISO standards) ensures compliance with contract terms. This aligns with L5M4’s focus on performance management by addressing root causes of underperformance rather than just penalizing it. Financial Link: Improved skills reduce waste or rework, lowering costs over time.

Strategy 2: Joint Process Improvement Initiatives:

Chapter 2 of the study guide advocates "collaborative approaches" to enhance supplier processes, such as joint problem-solving workshops or technology adoption. This is framed as a way to "achieve efficiency gains," a core financial management principle in L5M4.

Example in Context: A buyer and supplier might redesign packaging to reduce material costs by 10%, sharing the savings. This reflects the guide’s emphasis on mutual benefit and long-term value.

Strategy 3: Performance Incentives and Rewards:

The guide discusses "incentive mechanisms" as tools to drive supplier performance beyond minimum requirements. It suggests linking rewards to KPIs, such as delivery or quality metrics, to align supplier efforts with buyer goals.

Practical Application: Offering a contract extension for consistent performance (e.g., 98% quality compliance) motivates suppliers while securing supply chain stability, a key L5M4 outcome. Financial Benefit: Incentives can reduce monitoring costs by encouraging self-regulation.

Strategy 4: Investment in Supplier Resources:

The study guide recognizes that "direct investment" in a supplier’s infrastructure or resources can enhance their capacity to deliver. This might involve funding equipment, providing raw materials, or seconding staff. It’s positioned as a high-commitment strategy for critical suppliers.

Example: A buyer funding a supplier’s ERP system implementation improves order accuracy, reducing financial losses from errors.

Alignment with L5M4: This supports the module’s focus on achieving value for money by building supplier capability rather than switching to costlier alternatives. Broader Implications:

These strategies require careful selection based on the supplier’s role (e.g., strategic vs. transactional) and the contract’s goals. The guide advises assessing the cost-benefit of development efforts, ensuring they align with financial management principles like ROI.

For instance, training might suit a supplier with potential but poor skills, while incentives work better for one already capable but lacking motivation.

Collaboration and investment reflect a partnership mindset, fostering trust and resilience―key themes in L5M4 for managing complex contracts.

Implementation Considerations:

The guide stresses integrating development into the contract lifecycle, from supplier selection to performance reviews. Regular progress checks (e.g., quarterly audits) ensure strategies deliver results.

Financially, the initial cost of development (e.g., training fees) must be offset by long-term gains (e.g., reduced defect rates), a balance central to L5M4’s teachings.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Development and Improvement.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Cost-Benefit Analysis and Value Delivery.

정답: Innovation capacity refers to a supplier’s ability to develop, implement, and sustain new ideas, processes, products, or services that add value to their offerings and enhance the buyer’s operations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, assessing a supplier’s innovation capacity is crucial for ensuring long-term value, maintaining competitive advantage, and achieving cost efficiencies or performance improvements through creative solutions. Below is a detailed step-by-step solution: Definition of Innovation Capacity:

It is the supplier’s capability to generate innovative outcomes, such as improved products, efficient processes, or novel business models.

It encompasses creativity, technical expertise, resource availability, and a culture that supports innovation.

Why It Matters:

Innovation capacity ensures suppliers can adapt to changing market demands, technological advancements, or buyer needs.

It contributes to financial management by reducing costs (e.g., through process improvements) or enhancing quality, aligning with the L5M4 focus on value for money. Measures to Assess Innovation Capacity:

Research and Development (R&D) Investment: Percentage of revenue spent on R&D (e.g., 5% of annual turnover).

Number of Patents or New Products: Count of patents filed or new products launched in a given period (e.g., 3 new patents annually).

Process Improvement Metrics: Reduction in production time or costs due to innovative methods (e.g., 15% faster delivery).

Collaboration Initiatives: Frequency and success of joint innovation projects with buyers (e.g., 2 successful co-developed solutions).

Employee Innovation Programs: Existence of schemes like suggestion boxes or innovation awards (e.g., 10 staff ideas implemented yearly).

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of supplier innovation as a driver of contractual success and financial efficiency. While the guide does not explicitly define "innovation capacity," it aligns the concept with supplier performance management and the ability to deliver "value beyond cost savings." Innovation capacity is framed as a strategic attribute that enhances competitiveness and ensures suppliers contribute to the buyer’s long-term goals.

Detailed Definition:

Innovation capacity involves both tangible outputs (e.g., new technology) and intangible strengths (e.g., a proactive mindset). The guide suggests that suppliers with high innovation capacity can "anticipate and respond to future needs," which is critical in dynamic industries like technology or manufacturing.

It is linked to financial management because innovative suppliers can reduce total cost of ownership (e.g., through energy-efficient products) or improve return on investment (ROI) by offering cutting-edge solutions.

Why Assess Innovation Capacity:

Chapter 2 of the study guide highlights that supplier performance extends beyond meeting basic KPIs to delivering "strategic benefits." Innovation capacity ensures suppliers remain relevant and adaptable, reducing risks like obsolescence.

For example, a supplier innovating in sustainable packaging could lower costs and meet regulatory requirements, aligning with the L5M4 focus on financial and operational sustainability. Measures Explained:

R&D Investment:

The guide notes that "investment in future capabilities" is a sign of a forward-thinking supplier.

Measuring R&D spend (e.g., as a percentage of revenue) indicates commitment to innovation. A supplier spending 5% of its turnover on R&D might develop advanced materials, benefiting the buyer’s product line.

Patents and New Products:

Tangible outputs like patents demonstrate a supplier’s ability to innovate. The guide suggests tracking "evidence of innovation" to assess capability. For instance, a supplier launching 2 new products yearly shows practical application of creativity. Process Improvements:

Innovation in processes (e.g., lean manufacturing) can reduce costs or lead times. The guide links this to "efficiency gains," a key financial management goal. A 10% reduction in production costs due to a new technique is a measurable outcome.

Collaboration Initiatives:

The study guide encourages "partnership approaches" in contracts. Joint innovation projects (e.g., co-developing a software tool) reflect a supplier’s willingness to align with buyer goals. Success could be measured by project completion or ROI.

Employee Innovation Programs:

A culture of innovation is vital, as per the guide’s emphasis on supplier capability. Programs encouraging staff ideas (e.g., 20 suggestions implemented annually) indicate a grassroots-level commitment to creativity.

Practical Application:

To assess these measures, a company might use a supplier evaluation scorecard, assigning weights to each metric (e.g., 30% for R&D, 20% for patents). The guide advises integrating such assessments into contract reviews to ensure ongoing innovation.

For instance, a supplier with a high defect rate but strong R&D investment might be retained if their innovation promises future quality improvements. This aligns with L5M4’s focus on balancing short-term performance with long-term potential.

Broader Implications:

Innovation capacity can be a contractual requirement, with KPIs like "number of innovative proposals submitted" (e.g., 4 per year) formalizing expectations.

The guide also warns against over-reliance on past performance, advocating for forward-looking measures like those above to predict future value.

Financially, innovative suppliers might command higher initial costs but deliver greater savings or market advantages over time, a key L5M4 principle.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Supplier Performance and Strategic Value.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Achieving Value for Money.

정답: Key Performance Indicators (KPIs) are quantifiable metrics used to evaluate the success of an organization, project, or individual in meeting predefined objectives. Within the scope of the CIPS L5M4 Advanced Contract and Financial Management module, KPIs play a pivotal role in monitoring and managing contract performance, ensuring financial efficiency, and delivering value for money. They provide a structured framework to assess whether contractual obligations are being fulfilled and whether financial and operational goals are on track. KPIs are used to enhance transparency, foster accountability, support decision-making, and drive continuous improvement by identifying strengths and weaknesses in performance. Below is a detailed step-by-step solution: Definition of KPIs:

KPIs are specific, measurable indicators that reflect progress toward strategic or operational goals.

They differ from general metrics by being directly tied to critical success factors in a contract or financial context.

Characteristics of Effective KPIs:

Specific: Clearly defined to avoid ambiguity (e.g., "on-time delivery" rather than "good service").

Measurable: Quantifiable in numerical terms (e.g., percentage, cost, time).

Achievable: Realistic within the contract’s scope and resources.

Relevant: Aligned with the contract’s purpose and organizational goals.

Time-bound: Measured within a specific timeframe (e.g., monthly, quarterly).

Why KPIs Are Used:

Performance Monitoring: Track supplier or contractor adherence to agreed terms.

Risk Management: Identify deviations early to mitigate potential issues (e.g., delays or cost overruns).

Financial Control: Ensure budgets are adhered to and cost efficiencies are achieved.

Accountability: Hold parties responsible for meeting agreed standards.

Continuous Improvement: Provide data to refine processes and enhance future contracts.

Examples of KPIs:

Operational KPI: Percentage of On-Time Deliveries C Measures the supplier’s ability to deliver goods or services within agreed timelines (e.g., 98% of shipments delivered on schedule).

Financial KPI: Cost Variance C Compares actual costs to budgeted costs (e.g., staying within 5% of the allocated budget).

Quality KPI: Defect Rate C Tracks the proportion of defective items or services (e.g., less than 1% defects in a production batch).

Service KPI: Response Time C Evaluates how quickly a supplier addresses issues (e.g., resolving complaints within 24 hours).

Sustainability KPI: Carbon Footprint Reduction C Measures environmental impact (e.g., 10%

reduction in emissions from logistics).

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide positions KPIs as a cornerstone of effective contract management. According to the guide, KPIs are "quantifiable measures that allow organizations to assess supplier performance against contractual obligations and financial targets." They are not arbitrary metrics but are carefully selected to reflect the contract’s priorities, such as cost efficiency, quality, or timely delivery. The guide stresses that KPIs must be agreed upon by all parties during the contract negotiation phase to ensure mutual understanding and commitment.

Detailed Purpose:

Monitoring and Evaluation: Chapter 2 of the study guide explains that KPIs provide "a systematic approach to monitoring performance," enabling managers to track progress in real-time and compare it against benchmarks. For example, a KPI like "percentage of invoices paid on time" ensures financial discipline.

Decision-Making: KPIs offer data-driven insights, allowing contract managers to decide whether to escalate issues, renegotiate terms, or terminate agreements. The guide notes, "KPIs highlight variances that require corrective action."

Value for Money: The financial management aspect of L5M4 emphasizes KPIs as tools to ensure contracts deliver economic benefits. For instance, a KPI tracking "total cost of ownership" helps assess long-term savings beyond initial costs.

Risk Mitigation: By setting thresholds (e.g., maximum acceptable delay), KPIs act as early warning systems, aligning with the guide’s focus on proactive risk management. Practical Application:

The guide provides examples like "schedule performance index" (SPI), which measures progress against timelines, and "cost performance index" (CPI), which evaluates budget efficiency. These are often expressed as ratios (e.g., SPI > 1 indicates ahead of schedule).

Another example is "service level agreements" (SLAs), where KPIs such as "uptime percentage" (e.g., 99.9% system availability) are critical in IT contracts.

In a procurement context, KPIs like "supplier lead time" (e.g., goods delivered within 7 days) ensure supply chain reliability.

Why They Matter:

The study guide underscores that KPIs bridge the gap between contract terms and actual outcomes. They transform abstract goals (e.g., "improve quality") into concrete targets (e.g., "reduce defects by 15%"). This alignment is vital for achieving strategic objectives, such as cost reduction or customer satisfaction.

KPIs also facilitate stakeholder communication by providing a common language to discuss performance. For instance, a KPI report showing "90% compliance with safety standards" reassures clients and regulators alike.

Broader Implications:

In complex contracts, KPIs may be tiered (e.g., primary KPIs for overall success and secondary KPIs for specific tasks). The guide advises balancing quantitative KPIs (e.g., cost savings) with qualitative ones (e.g., customer feedback scores) to capture a holistic view.

Regular review of KPIs is recommended to adapt to changing circumstances, such as market fluctuations or new regulations, ensuring they remain relevant throughout the contract lifecycle.

Reference: CIPS L5M4 Study Guide, Chapter 2: Performance Management in Contracts, Section on Key Performance Indicators.

Additional

Reference: Chapter 4: Financial Management in Contracts, Section on Measuring Financial Performance